percent change in working capital formula

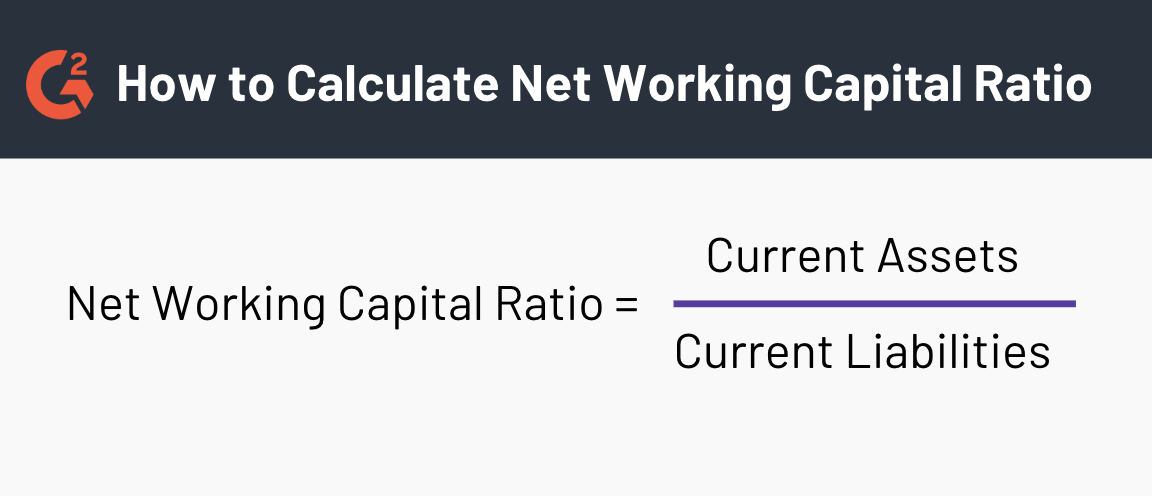

For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this. It is used for many purposes in finance.

Change In Net Working Capital Nwc Formula And Calculator

The formula is working capital divided by gross sales times 100.

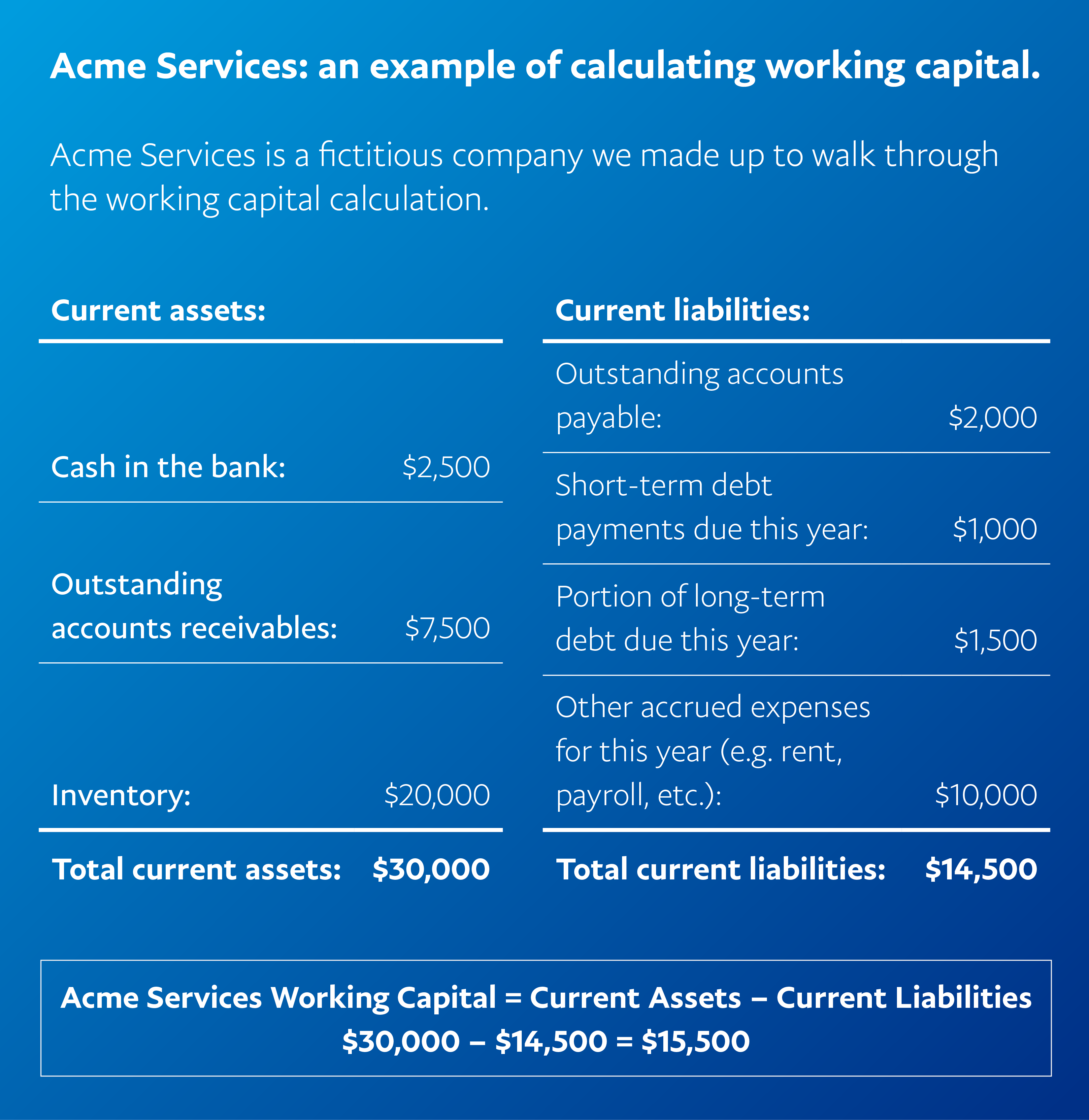

. Secondly the coming years sales forecast is. Working Capital Current Assets Current Liabilities. Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time.

Net Working Capital NWC 75mm 60mm 15mm. Firstly figure out the value of the subject variable at the start of the given period which is considered as the original value. If the result is positive then it is an increase.

Then multiply the answer by 23 because there was a 23 increase in rainfall. Changes in working capital -2223. Next you divide the increase or decrease by the first initial value.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. If this ratio is around 12 to 18 This is generally said to be a balanced ratio and it is assumed that the company is in a healthy state to pay its liabilities. For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

If we know the average rainfall is 250mm we can work out the rainfall for the period by calculating 250 23. Change in Other Current Assets 1466 1333 133. Finally the Change in Working as calculated manually on the Balance Sheet will rarely if ever match the figure reported by the company on its Cash Flow Statement.

Change in Inventory 9497 8992 505. This measurement is important to management vendors and general creditors. Working Capital Ratio Formula.

First find the difference between the two values you want to compare. Next figure out the value of the same variable by. You just need to minus the current years working capital from last years.

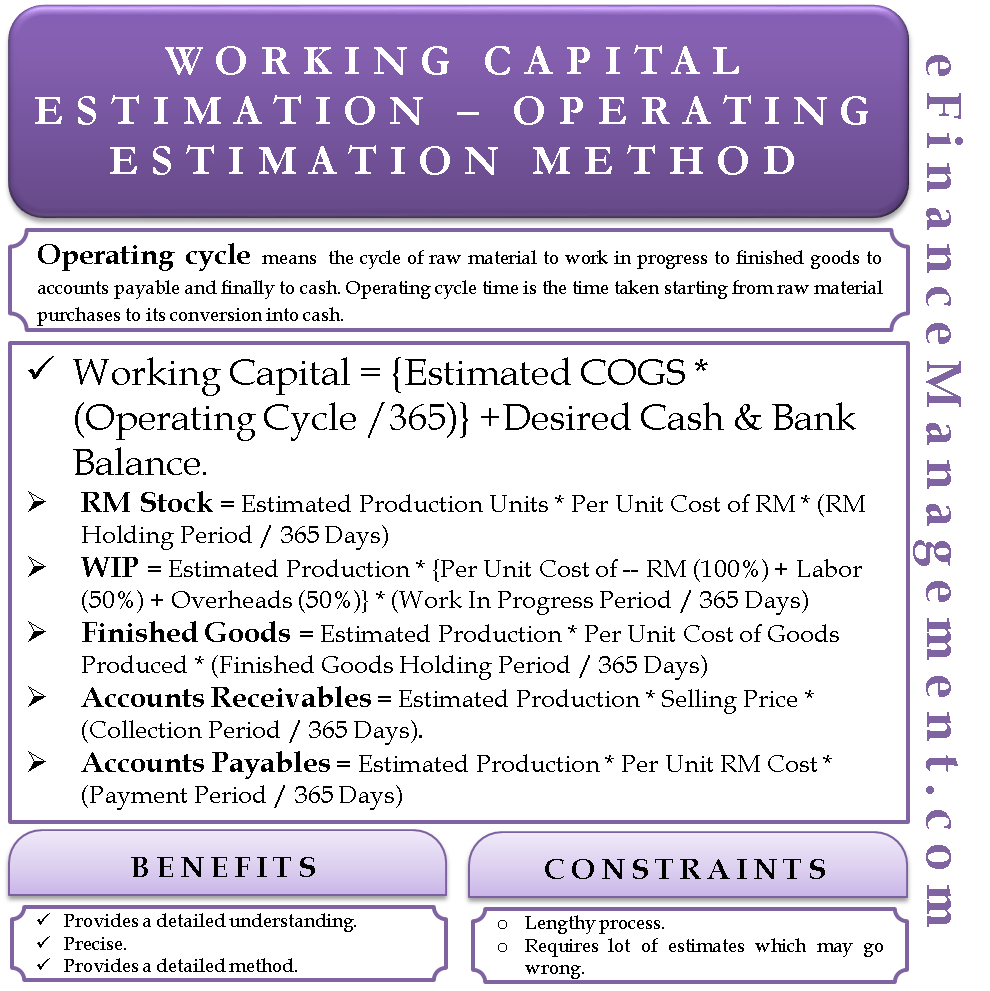

The second is to base our changes on non-cash working capital as a percent of revenues in the most recent year and expected revenue growth in future years. Likewise calculate for the rest of the years. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow.

Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. Net working capital is a liquidity calculation that measures a companys ability to pay off its current liabilities with current assets. In the case of the Gap that would indicate that non-cash working capital changes in future years will be 344 of revenue changes in that year.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. In this example the change in working capital in 2021 comes to be negative -24046000000. How do you calculate percentage change in working capital.

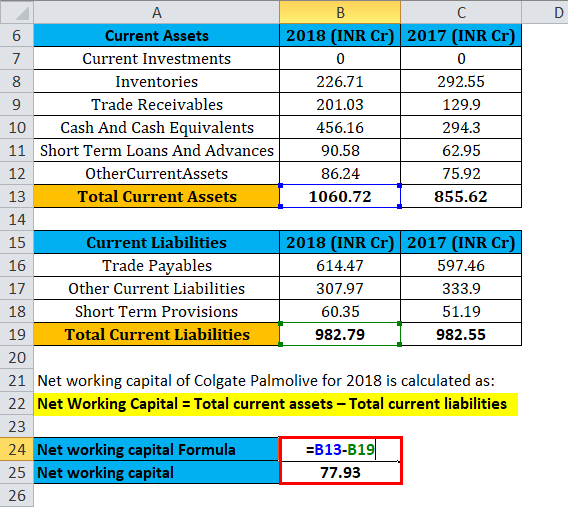

Net Working Capital Formula Working Capital Formula. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20.

Percentage change is a simple mathematical concept that represents the degree of change over time. This presentation gives investors and creditors more information to analyze about the company. The working capital ratio is calculated by dividing current assets by current liabilities.

First each component of working capital as a percentage of sales is calculated. Current Operating Assets 50mm AR 25mm Inventory 75mm. The last step is to find the change in net working capital.

Current assets and liabilities are. Owner Earnings 8903 14577 5129 13312 2223 13084. Working Capital Ratio Current Assets Current Liabilities.

Then after multiplying that by 100 to get a percentage youre all set. 25 23 575. Examples of Changes in Working Capital Therefore working capital will.

The net working capital ratio measures the proportion of a businesss short-term net cash to its assets. First work out 1 of 250 250 100 25. If it is less than 1 It is known as negative working capital which generally means that the company cannot pay.

Heres an example for Target. Both of these current accounts are stated separately from their respective long-term accounts on the balance sheet. Heres the formula for percentage increase.

As for the rest of the forecast well be using the. The Percentage Change Formula can be calculated by using the following steps. The percentage of sales method is the simplest and easiest way of finding future working capital.

10 Essential Tools For Working With Pallets 1001 Pallets Marketing Metrics Measurement Tools Customer Engagement

Investment Banking Courses Investment Banking Banking Money Management Advice

Sample Financial Statement Analysis Example Financial Statement Analysis Financial Statement Analysis

When Does The Cost Of The Inventory Become An Expense Cost Of Goods Sold Income Statement Cost Of Goods

Change In Net Working Capital Nwc Formula And Calculator

A Simple Breakdown To The Working Capital Formula Paypal

Working Capital Estimation Operating Cycle Method

Download Employee Absent Rate Calculator Excel Template Exceldatapro Excel Templates Excel Shortcuts Excel

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

Change In Net Working Capital Nwc Formula And Calculator

Changes In Net Working Capital All You Need To Know

Cashflow Problems Keep The Money Coming In Small Business Finance Small Business Funding Business Funding

How To Calculate Working Capital Turnover Ratio Flow Capital

What Is Net Working Capital How To Calculate Nwc Formula

Mcq Working Capital Management Cpar 1 84 Lettering Finance Statute Of Frauds

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)